Best Stock Investments In A Bear Market

The markets are crashing, how can you profit from this?

I never recommend going short on a stock. Way too risky and your broker can kick you out of the trade right before it’s about to rebound. I recommend going to a savings account, buying an inverse ETF, or buying stock puts. If you must invest, in this post you’ll discover how to pick the best stock investments in a bear market.

Since the stock market is much like the ocean, it goes up and down. Sometimes the waves are strong and suck you under. To stay afloat you need a life preserver. The life preserver I use in the ocean of stocks is Sectors and Industries. There is always one sector that seems to move higher when everyone else is being sucked under. On June 30, 2008 the hot sector was Energy. The markets were down 14% for the year and this sector was producing stocks that gained 400% and more in just the last few months. Truly one of the best stock investments.

Best Stock Investments In Hot Sectors

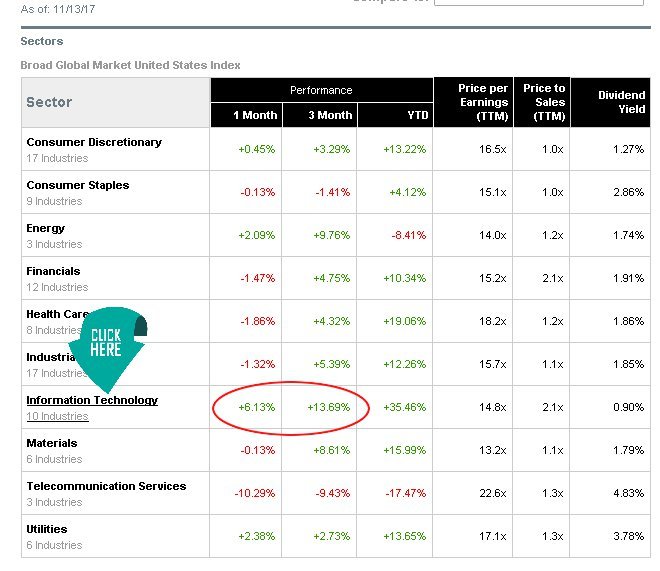

To identify the hot sectors (you should be hearing about them in the news consistently) you can always look in the financial papers or online website also.

In the picture above, you can see how I weed out sectors using the Bloomberg website. You want to look for the sector that has been performing the best over the last 3 months (see the red circle). Under the sector name you will see that there are 10 industries in that hot sector. Click on the name and it will take you to the list of industries in that sector.

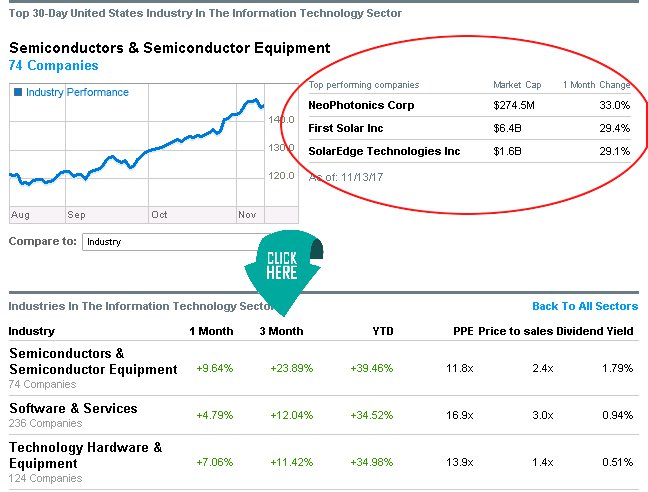

Once you get to the industry list, click on “3 Month” column to display the industries ranked by biggest gainers to the lowest. In this example you will see the best performing industry is Semiconductors.

In the red circle, you can see the top three stocks based on 1 month performance. These are the leaders. If you look at their charts you will see a pattern of the stock moving consistently higher over the last 6 months or more. These usually make the best stock investments over the long term during a bear market.

Now if you are looking for some great short term profits over a weeks time or a month, look in the same industry but look at the laggards (the ones that have the worst performance). Look at their chart and find the ones that look like they have reached a bottom. You don’t want to see a chart where the price is getting lower each day. You want to look for one that hit its low point and is either moving sideways or been rising the last week or so. Put these on a watch list. Watch these stocks for one that gains 10% or more in one day on BIG volume. This would make a great short term play.

Why This Works

The reason this works is all in the mentality of the investors. When a sector or industry takes off, it’s the leaders in that sector who gain the most. They lead the way. As more and more investors get in on the bandwagon, this sector and the leaders rise in price. Soon more people want to invest in this popular sector. When they look at the prices of the leaders they see three digit numbers. “That’s too expensive” they think, but they don’t want to be left out either so they buy the laggards. Now all these companies with horrible earnings start to take off. You want to jump in right when they take off. So keep an eye out for the 10% jump.

Here is a warning, like the housing and tech bubbles of the past, this hot sector will eventually tank. It is the laggards that drop the most first. This is why I recommend them as short term investments only.