5 Ways To Avoid An Investment Ponzi Scam

Looking to avoid a Ponzi scam? Here the 5 things you must ask yourself if you wish to avoid this growing financial crime called a “Ponzi Scheme” or “Ponzi Scam”. Like the “Pump and Dump” scheme, you can spot this scam BEFORE becoming a victim and losing your life savings.

What Is A Ponzi Scam?

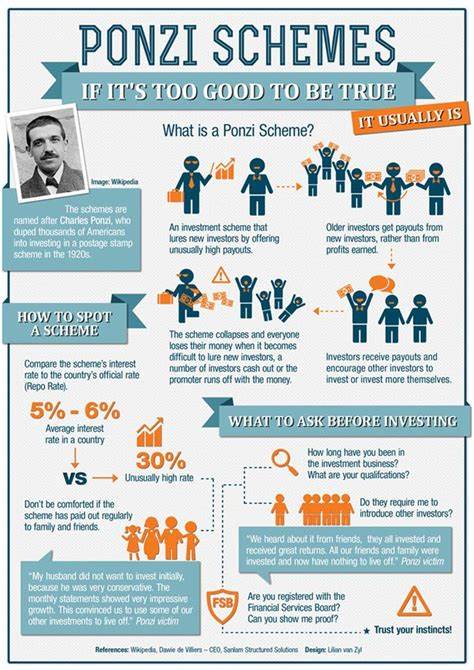

A ponzi scam involves the payment of purported returns to existing investors from funds contributed by new investors. Organizers of Ponzi schemes often attract new investors with promises of high returns with little or no risk. In most Ponzi schemes, the fraudsters focus on attracting new money to make promised payments to earlier-stage investors and to use for personal expenses, instead of engaging in any legitimate investment activity.

5 Questions You Must Ask

Before you hand your money over to anyone, make sure you ask these five questions:

1. Is the seller licensed?

Federal and state securities laws require investment professionals and their firms to be licensed or registered. Most Ponzi schemes involve unlicensed individuals or unregistered firms. You can check on the status of any firm or individual by visiting the SEC website.

2.Is the investment registered?

Ponzi schemes typically involve investments that have not been registered with the SEC or with state regulators. Registration is important because it provides investors with access to key information about the company’s management, products, services, and finances.

3. How do the risks compare with the potential rewards?

Every investment carries some degree of risk. Investments yielding higher returns typically involve more risk. Be suspect of an investment that continues to generate regular, positive returns regardless of overall market conditions.

4. Do I understand the investment?

Most Ponzi schemes claim they can consistently achieve big returns because of some secret or complex investment vehicle. Avoiding investments you don’t understand or for which you can’t get complete information is a good rule of thumb.

5. Where can I turn for help? Again the SEC is a valuable resource of information. Make sure you do your research BEFORE you invest, not after you feel you have already become a victim.

In addition to these five questions you must also take a good look at yourself. Most all victims of Ponzi schemes are people who are greedy and lazy. Yes we all want the best return, but if it sounds too good, it probably is. So check your greed at the door and research the investment thouroughly.

Learning To Place Your Own Trades

No one is going to take as good care of your money as you are. Everyone should learn how to invest and handle their own finances.

Granted it takes time researching strategies and stocks, but you don’t need to do that. There are many reputable services that will do that research for you at a small monthly fee. The important thing is that your money is in your brokerage account and only you can access the funds. No fraudster can siphon off your money for his/her personal pleasure.

You can still be lazy with this, just subscribe to a profitable ETF alert service and when they email you ETF’s for investment, just log on to your brokerage account and spend five minutes making a trade.

No matter how much money you have, no matter how old you are, it is so easy to invest your own money. If anyone falls victim to a Ponzi scam, they really have no one to blame but themselves for not taking a few minutes out of their life to learn how to place a simple stock trade.