THE JANUARY EFFECT

Today I’m examining a trading strategy called the “January Effect“. This trading strategy is aptly named because it’s designed to be traded only in the month of January. I’ve run the numbers and now it’s time to reveal if this trading strategy is a money maker or a money burner.

Wall Street has maintained that stocks rise in January. As such, going long with a buy and hold approach is the way to trade the January Effect. Here is what Investopedia has to say about the January Effect:

A general increase in stock prices during the month of January. This rally is generally attributed to an increase in buying, which follows the drop in price that typically happens in December when investors, seeking to create tax losses to offset capital gains, prompt a sell-off.

Investopedia

How Effective Is The January Effect?

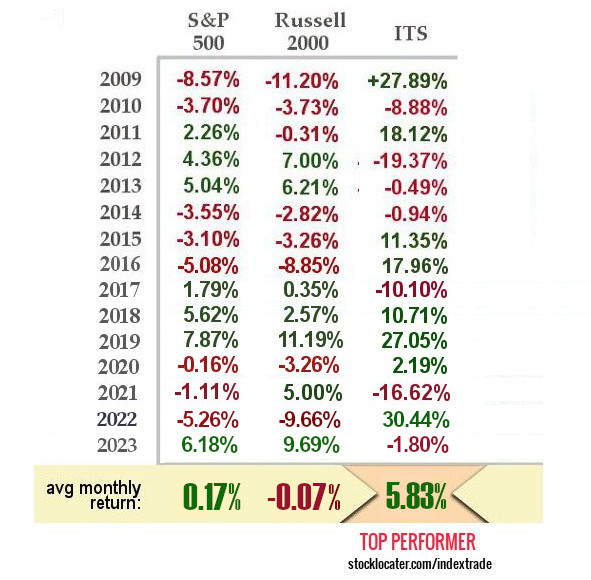

To test any strategy, you need a good 10 years. I’ve been tracking it since the bottom of the housing crash of 2008. This was the beginning of what has become known as the greatest bull market of all time. With a 15 year time frame to evaluate, surely the “experts” must have made money.

FAIL

Trade The January Effect The Right Way

OK, the verdict on the January Effect shows neither index able to show a decent gain after 15 years. If you can find an investment that returns MORE, you are better off putting your funds in that during January.

One such investment option to help traders profit in January is our Index Trading Service. We email/text our subscribers what to buy and sell in January. We use index ETF’s to trade the markets. You can see the returns our subscribers achieved for the last 15 years in the chart above.

Just joining and trading with us in the month of January ONLY, you would be averaging almost 6% monthly. Provided of course you trade at least ten months of January or more. With a 6% gain, you can sit out the rest of the year and earn an additional 2%-4% in a savings giving you a relatively safe investment of 8% to 10% a year.

There is no guarantee the next 15 years will produce the same results, but we can only make decisions on the future based on our past experiences.